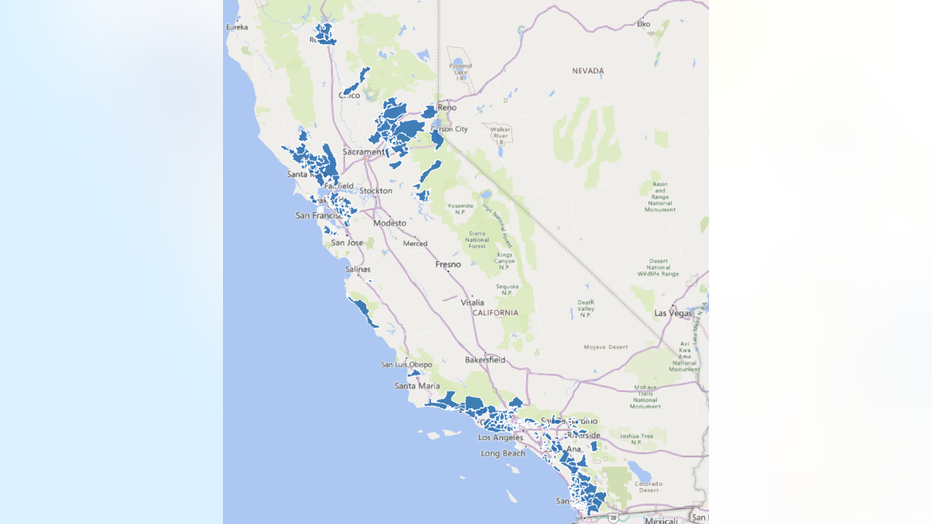

State filing shows California zip codes where State Farm plans to drop policy holders

ORINDA, Calif. - A recent state filing by State Farm shows exactly where California's largest home insurer plans to drop tens of thousands of policyholders because of significant wildfire risk.

Zip code 94563, which includes the City of Orinda, tops the list, where more than 50% of policyholders are expected to be impacted.

"It doesn’t sit well," said Angela Xu, who is waiting to find out if State Farm will continue to insure her home in Orinda. "If there’s an increased risk, I’m happy to pay more for it, but it’s like we’re not even being given an option."

Featured

State Farm not renewing some 72,000 policies when they expire due to risk

State Farm California's largest property/casualty insurer, selling to one in every four homes, has announced that it will not renew some 72,000 policies when they expire. The reason: in State Farm's opinion, those homes are too risky to insure

The Illinois-based company cited soaring costs, the increasing risk of natural disasters like wildfires, and outdated regulations, as reasons it won’t renew the polices of 30,000 homes statewide.

"What you’re seeing is what we were expecting. They’re going and non-renewing properties that are in the highest risk areas," said Karl Susman, who owns Susman Insurance Agency.

Susman said those areas include places in the hills closest to brush, like Santa Rosa, the Oakland Hills and Orinda.

"We tried to go with State Farm, and they said no, unfortunately we’re not covering you," said Eddie Chen, another homeowner in Orinda, who was forced to seek home insurance elsewhere. "People are just having a hard time getting coverage in our area…If there are fewer insurers to choose from, then it gives us less pricing power."

A few streets over, the Christianson’s said they recently had their policy dropped by AAA.

State Farm to drop thousands of California policy holders this year

California's largest home insurer, State Farm, plans to drop tens of thousands of policyholders later this year because of significant wildfire risk. Those customers will not have their policies renewed once their current contract is up. Many of them live in Contra Costa, Sonoma, Santa Clara and Santa Cruz Counties. KTVU's Alex Savidge and Jana Katsuyama discuss the changes with Karl Susman, insurance expert and broker with Susman Insurance Agency.

"It just seems unreasonable for folks in California," said Helena Christianson. "It feels like [we] kind of keep getting these huge corporations that make the decisions, and the community has very little decision-making.There are things that the city is doing for fire prevention. Of course, there’s always more to do, but it feels like those proactive measures aren’t being taken into consideration."

California's insurance regulator is currently in the process of pursuing reforms to address this very issue.

As far as when State Farm customers can expect to learn about the status of their policies, Susman says the vast majority of impacted customers have already been notified.

Map shows some of the areas where State Farm is dropping coverage.